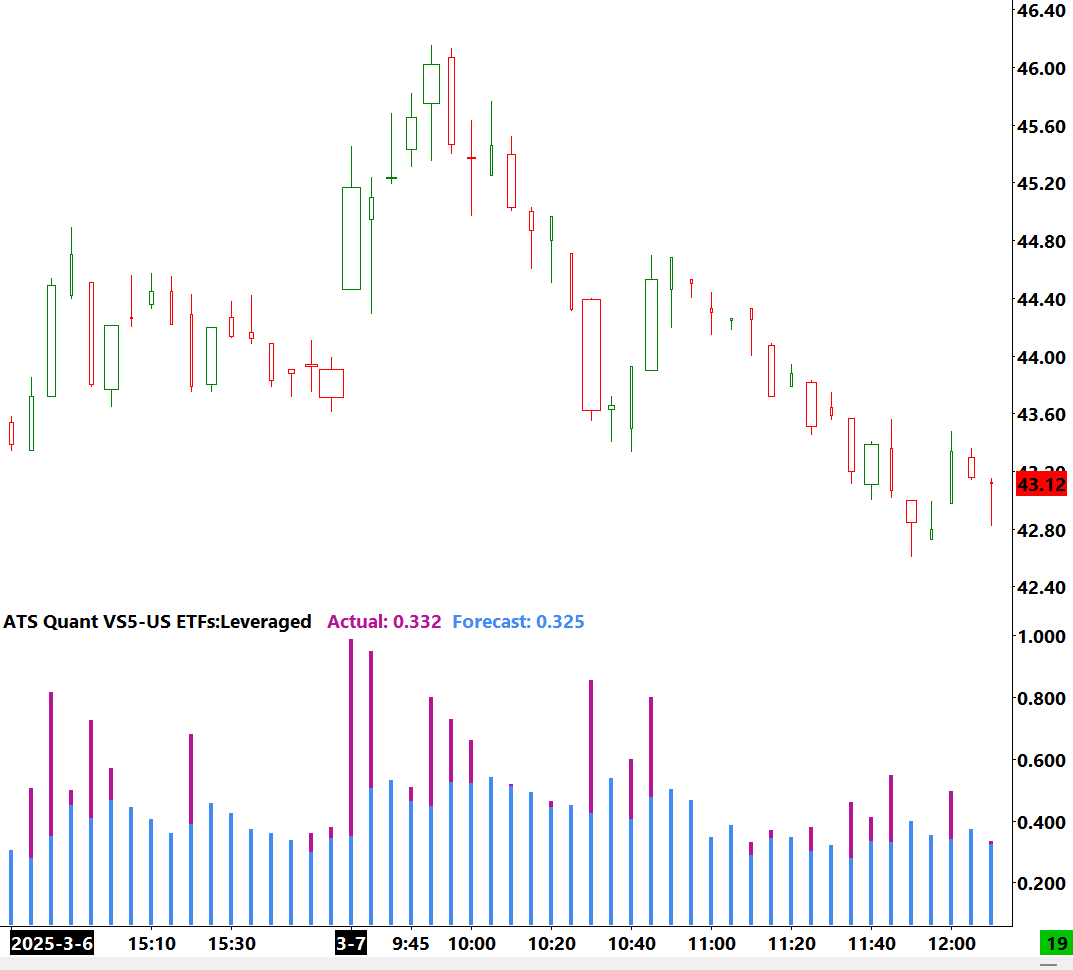

ATS Quant Volatility Scalp5 US ETFs:Leveraged

This machine learning system was trained to forecast volatility for the next bar of US Leveraged ETFs.

The system was trained on the following categories of US Leveraged ETFs :

Leveraged Bonds, Leveraged Equities, Leveraged Multi-Asset,

Leveraged Real Estate, Leveraged VolatilityThis model can be applied to the following ETFs:

AAPB, AAPU, AMZU, BDCX, BIB, BNKU, BULZ, CLDL,

CONL, CURE, DDM, DFEN, DIG, DPST, DRN, DRV, DUSL,

ERX, EVAV, FAS, FBL, FLYU, FNGG, FNGO, GDE, GGLL,

GUSH, HDLB, HIBL, IWML, LABU, LTL, MIDU, MSFU,

MSOX, MVRL, MVV, NAIL, NVDL, NVDU, OOTO, PFFL,

PILL, QLD, QTJA, QTOC, REK, RETL, ROM, RXL, SAA,

SKYU, SMHB, SMLL, SPUU, SPXL, SPYU, SRS, SSO,

TECL, TECS, TMF, TNA, TPOR, TQQQ, TSL, TSLL, TYD,

UBT, UCC, UDOW, UGE, UJB, UMDD, UPRO, UPW, URE,

URTY, USD, UST, UTSL, UVXY, UWM, UXI, UYG, WANT,

WEBL, WTID, XBJL, XDAP, XDJL, XDSQ, XJUN, XTJA,

XTJL, XTOCThis machine learning system can be used to improve risk management, trade management, execution and development of strategies on US Leveraged ETFs.

The model has learned to distinguish the difference between the behavior of different instruments and thus will alter its forecasts to fit the orderflow of the current instrument.

This model is designed specifically for 5 min samples (i.e. candles, numbers bars, etc).

Updates and improved versions of this model are included with this subscription.

This version of the model integrates directly into Sierra Charts.

At sign-up you will need a valid Sierra Charts account. This model is valid across all Sierra Charts package options.

ATS Quant Volatility Scalp5 US ETFs:Leveraged

This machine learning system was trained to forecast volatility for the next bar of US Leveraged ETFs.

The system was trained on the following categories of US Leveraged ETFs :

Leveraged Bonds, Leveraged Equities, Leveraged Multi-Asset,

Leveraged Real Estate, Leveraged VolatilityThis model can be applied to the following ETFs:

AAPB, AAPU, AMZU, BDCX, BIB, BNKU, BULZ, CLDL,

CONL, CURE, DDM, DFEN, DIG, DPST, DRN, DRV, DUSL,

ERX, EVAV, FAS, FBL, FLYU, FNGG, FNGO, GDE, GGLL,

GUSH, HDLB, HIBL, IWML, LABU, LTL, MIDU, MSFU,

MSOX, MVRL, MVV, NAIL, NVDL, NVDU, OOTO, PFFL,

PILL, QLD, QTJA, QTOC, REK, RETL, ROM, RXL, SAA,

SKYU, SMHB, SMLL, SPUU, SPXL, SPYU, SRS, SSO,

TECL, TECS, TMF, TNA, TPOR, TQQQ, TSL, TSLL, TYD,

UBT, UCC, UDOW, UGE, UJB, UMDD, UPRO, UPW, URE,

URTY, USD, UST, UTSL, UVXY, UWM, UXI, UYG, WANT,

WEBL, WTID, XBJL, XDAP, XDJL, XDSQ, XJUN, XTJA,

XTJL, XTOCThis machine learning system can be used to improve risk management, trade management, execution and development of strategies on US Leveraged ETFs.

The model has learned to distinguish the difference between the behavior of different instruments and thus will alter its forecasts to fit the orderflow of the current instrument.

This model is designed specifically for 5 min samples (i.e. candles, numbers bars, etc).

Updates and improved versions of this model are included with this subscription.

This version of the model integrates directly into Sierra Charts.

At sign-up you will need a valid Sierra Charts account. This model is valid across all Sierra Charts package options.