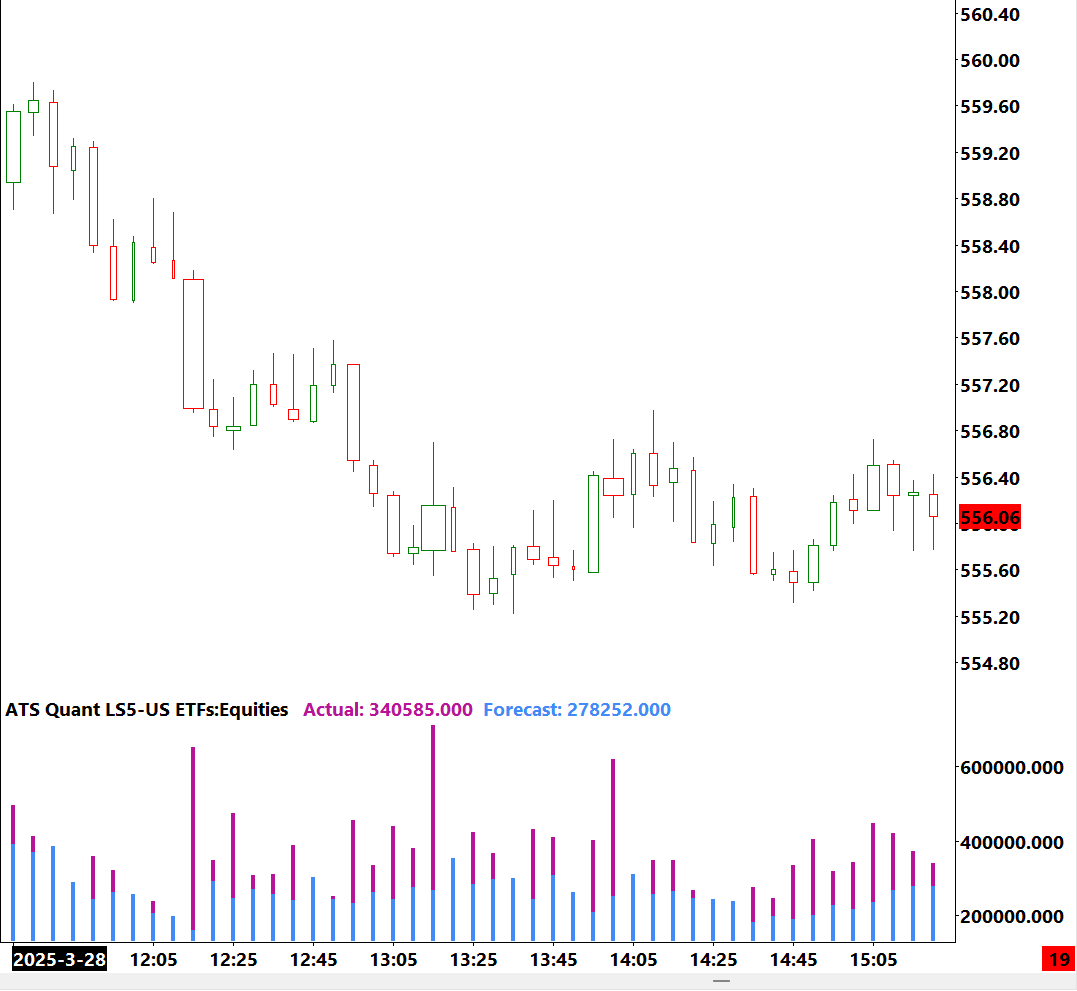

ATS Quant Liquidity Scalp5 US ETFs: Equities

This liquidity model forecasts the amount of liquidity for the next bar at the close of the current bar.

This insight can be used to improve timing of entries for break out strategies, to confirm changes in orderflow and to identify when and where institutions are likely executing orders.

Liquidity, or volume, is a fundamental component of all markets. This model is actively reading the orderflow tick by tick. This ability, in addition to having been trained on significant sums of orderflow events, provides users with a proactive tool for profiting from market generated information.

The system was trained on the following categories of US Equity ETFs which were approximately 1000 individual ETFs:

All Cap Equities,

Alternative Energy Equities,

Communications Equities,

Consumer Discretionary Equities,

Consumer Staples Equities,

Emerging Markets Equities,

Energy Equities,

Europe Equities,

Financials Equities,

Global Equities,

Health & Biotech Equities,

Industrials Equities,

Inverse Equities,

Large Cap Blend Equities,

Large Cap Growth Equities,

Large Cap Value Equities,

Leveraged Equities,

Mid Cap Blend Equities,

Mid Cap Growth Equities,

Mid Cap Value Equities,

Small Cap Blend Equities,

Small Cap Growth Equities,

Small Cap Value Equities,

Technology Equities,

Transportation Equities,

Utilities Equities,

Water Equities,

Building & Construction,

MaterialsThis model is designed specifically for 5 min samples (i.e. candles, numbers bars, etc).

The model has learned to distinguish the difference between the behavior of different instruments and thus will alter its forecasts to fit the orderflow of the current instrument.

Updates and improved versions of this model are included with this subscription.

This version of the model integrates directly into Sierra Charts.

At sign-up you will need a valid Sierra Charts account. This model is valid across all Sierra Charts package options.

ATS Quant Liquidity Scalp5 US ETFs: Equities

This liquidity model forecasts the amount of liquidity for the next bar at the close of the current bar.

This insight can be used to improve timing of entries for break out strategies, to confirm changes in orderflow and to identify when and where institutions are likely executing orders.

Liquidity, or volume, is a fundamental component of all markets. This model is actively reading the orderflow tick by tick. This ability, in addition to having been trained on significant sums of orderflow events, provides users with a proactive tool for profiting from market generated information.

The system was trained on the following categories of US Equity ETFs which were approximately 1000 individual ETFs:

All Cap Equities,

Alternative Energy Equities,

Communications Equities,

Consumer Discretionary Equities,

Consumer Staples Equities,

Emerging Markets Equities,

Energy Equities,

Europe Equities,

Financials Equities,

Global Equities,

Health & Biotech Equities,

Industrials Equities,

Inverse Equities,

Large Cap Blend Equities,

Large Cap Growth Equities,

Large Cap Value Equities,

Leveraged Equities,

Mid Cap Blend Equities,

Mid Cap Growth Equities,

Mid Cap Value Equities,

Small Cap Blend Equities,

Small Cap Growth Equities,

Small Cap Value Equities,

Technology Equities,

Transportation Equities,

Utilities Equities,

Water Equities,

Building & Construction,

MaterialsThis model is designed specifically for 5 min samples (i.e. candles, numbers bars, etc).

The model has learned to distinguish the difference between the behavior of different instruments and thus will alter its forecasts to fit the orderflow of the current instrument.

Updates and improved versions of this model are included with this subscription.

This version of the model integrates directly into Sierra Charts.

At sign-up you will need a valid Sierra Charts account. This model is valid across all Sierra Charts package options.