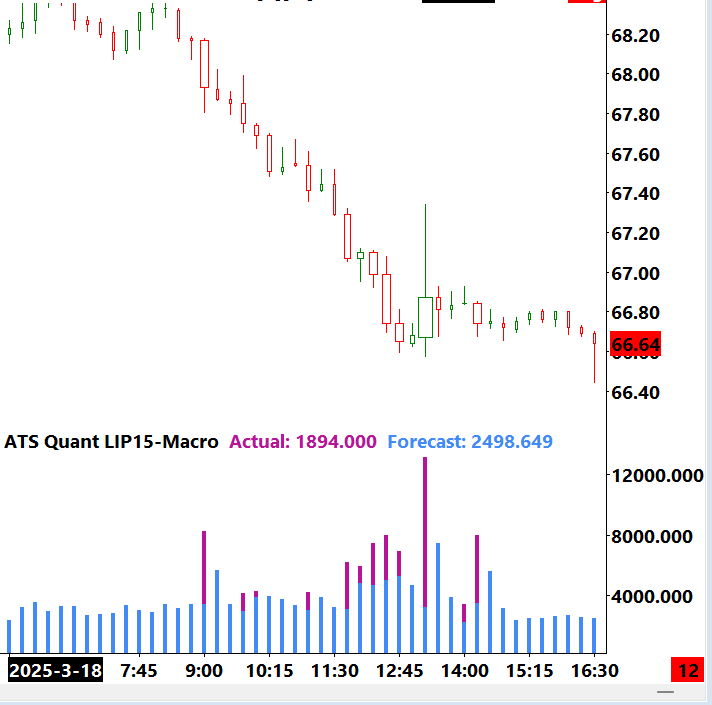

ATS Quant Liquidity Intraday Position 15 Macro

This machine learning system forecasts liquidity for the next bar.

The system can be applied to the following instruments:

-E-Mini S&P 500 Futures

-E-Mini Nasdaq 100 Futures

-Gold Futures

-WTI Crude Oil (CL) Futures

-Australian Dollar Futures

-British Pound Futures

-Canadian Dollar Futures

-Euro FX Futures

-Japanese Yen Futures

The model was trained to read the orderflow and forecast future liquidity. This means that the model dynamically adjusts its forecast based on shifts in market states.

The system understands the difference between the microstructure of each instrument and thus adjusts its forecasts based on the current instrument.

Liquidity forecasting can be used to indicate the entrance of institutional flow, as a filter for existing strategies, and to create robust trading strategies. It can also be used as a signal to reduce exposure and or activity to prevent overtrading.

This model is designed specifically for 15 min samples (i.e. candles, numbers bars, etc).

Updates and improved versions of this model are included with this subscription.

This version of the model integrates directly into Sierra Charts.

At sign-up you will need a valid Sierra Charts account. This model is valid across all Sierra Charts package options.

*additional instruments not listed will be added in future releases

*WTI Crude featured in thumbnail

ATS Quant Liquidity Intraday Position 15 Macro

This machine learning system forecasts liquidity for the next bar.

The system can be applied to the following instruments:

-E-Mini S&P 500 Futures

-E-Mini Nasdaq 100 Futures

-Gold Futures

-WTI Crude Oil (CL) Futures

-Australian Dollar Futures

-British Pound Futures

-Canadian Dollar Futures

-Euro FX Futures

-Japanese Yen Futures

The model was trained to read the orderflow and forecast future liquidity. This means that the model dynamically adjusts its forecast based on shifts in market states.

The system understands the difference between the microstructure of each instrument and thus adjusts its forecasts based on the current instrument.

Liquidity forecasting can be used to indicate the entrance of institutional flow, as a filter for existing strategies, and to create robust trading strategies. It can also be used as a signal to reduce exposure and or activity to prevent overtrading.

This model is designed specifically for 15 min samples (i.e. candles, numbers bars, etc).

Updates and improved versions of this model are included with this subscription.

This version of the model integrates directly into Sierra Charts.

At sign-up you will need a valid Sierra Charts account. This model is valid across all Sierra Charts package options.

*additional instruments not listed will be added in future releases

*WTI Crude featured in thumbnail