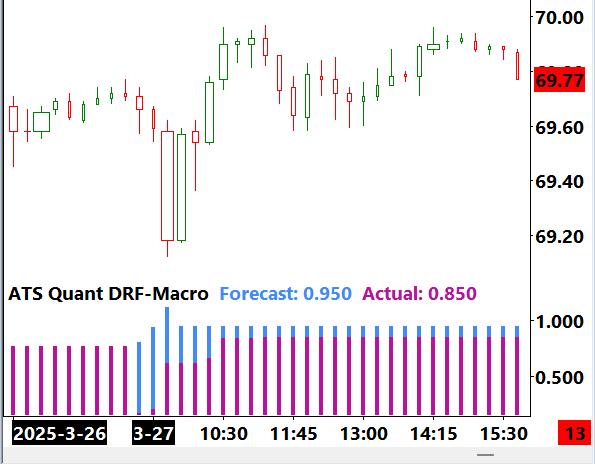

ATS Quant Daily Range Forecast Macro

Machine Learning model that forecasts the range of the current day. Model begins by monitoring order flow at the start of the session. Once it has collected enough data it makes a forecast for the day’s range.

The forecast is set and remains constant while the day’s range is updating. This allows the trader to 1) have a quantitative and visual representation of how active a market is likely to be 2) visually detect divergence between the expected range or level of activity and the actual level of activity.

Instruments:

-E-Mini S&P 500 Futures

-E-Mini Nasdaq 100 Futures

-Gold Futures

-WTI Crude Oil (CL) Futures

-Australian Dollar Futures

-British Pound Futures

-Canadian Dollar Futures

-Euro FX Futures

-Japanese Yen Futures

The session’s range represents the potential trading opportunity during the session. This model can be used to optimize whether you should scalp or position trade. The comparison between the forecasted daily range and the actual daily range can be used to detect deviations in order flow from one half of the session to the other.

The system can be used to improve risk management by adjusting one’s level of activity based upon the expected level of opportunity. This can be done early in the session when conducting scenario analysis or later in the session when determining whether to continue trading or if a smaller position size should be traded to preserve gains.

This model is designed to process information in 15min intervals and thus should be applied to 15min samples (i.e. charts, numbers bars, etc).

Updates and improved versions of this model are included with this subscription.

This version of the model integrates directly into Sierra Charts.

At sign-up you will need a valid Sierra Charts account. This model is valid across all Sierra Charts package options.

*additional instruments will be included in future updates

*WTI Crude pictured

*Note: This system has been trained on the North American Session. Future releases will include European and Asian sessions.

ATS Quant Daily Range Forecast Macro

Machine Learning model that forecasts the range of the current day. Model begins by monitoring order flow at the start of the session. Once it has collected enough data it makes a forecast for the day’s range.

The forecast is set and remains constant while the day’s range is updating. This allows the trader to 1) have a quantitative and visual representation of how active a market is likely to be 2) visually detect divergence between the expected range or level of activity and the actual level of activity.

Instruments:

-E-Mini S&P 500 Futures

-E-Mini Nasdaq 100 Futures

-Gold Futures

-WTI Crude Oil (CL) Futures

-Australian Dollar Futures

-British Pound Futures

-Canadian Dollar Futures

-Euro FX Futures

-Japanese Yen Futures

The session’s range represents the potential trading opportunity during the session. This model can be used to optimize whether you should scalp or position trade. The comparison between the forecasted daily range and the actual daily range can be used to detect deviations in order flow from one half of the session to the other.

The system can be used to improve risk management by adjusting one’s level of activity based upon the expected level of opportunity. This can be done early in the session when conducting scenario analysis or later in the session when determining whether to continue trading or if a smaller position size should be traded to preserve gains.

This model is designed to process information in 15min intervals and thus should be applied to 15min samples (i.e. charts, numbers bars, etc).

Updates and improved versions of this model are included with this subscription.

This version of the model integrates directly into Sierra Charts.

At sign-up you will need a valid Sierra Charts account. This model is valid across all Sierra Charts package options.

*additional instruments will be included in future updates

*WTI Crude pictured

*Note: This system has been trained on the North American Session. Future releases will include European and Asian sessions.